- ICSD

- Oct 31, 2025

- 4 min read

Updated: Nov 1, 2025

Ending the “Disposal Society”: A Key Crossroads for the UK’s FMCG and Circular Economy Transition

Jacob Wan, ICSD Youth Ambassador

On 27 March 2025, the UK Environment Secretary, Steve Reed, delivered a policy speech at Dock Shed in London, announcing that the government would adopt a crosssector and cross-industry action blueprint to drive the UK’s ambition to “end the disposal society” and accelerate its transition to a circular economy.

To this end, the government established the Circular Economy Taskforce, chaired by Andrew Morlet, former CEO of the Ellen MacArthur Foundation. The taskforce will focus on five priority sectors: textiles, transport, construction, agri-food, and chemicals and plastics. It has pledged to provide businesses with the certainty needed for effective planning and investment through the forthcoming circular economy strategy and sectoral roadmaps—aimed at stimulating investment in recycling infrastructure and green jobs.

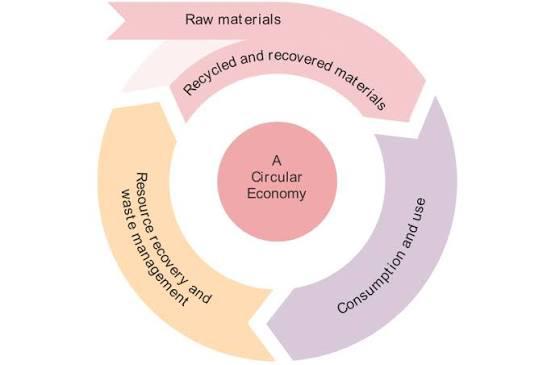

This marks not only a major policy shift in UK environmental governance but also a signal of structural adjustments in supply chain management, industrial upgrading, and the management of geopolitical risks. The fast-moving consumer goods (FMCG) sector—situated closest to the consumer end of the supply chain—has long supported the retail market through its high turnover and extensive packaging. Yet, precisely because of its scale and speed, it bears the brunt of pressures concerning packaging waste, limited recyclability, and the governance of post-consumer behaviour.

Recent industry observations and public data show that the UK’s household waste recycling rate was approximately 44.1% in 2022, a slight decline from 2021, with significant regional disparities. This indicates that the entire chain—spanning policy, infrastructure, corporate design, and consumer habits—still requires coordinated and simultaneous upgrading to enable higher levels of reuse and material recycling.

In terms of governance tools, the UK Plastic Packaging Tax has entered a new phase of data transparency and normalised compliance. As of 6 August 2025, 4,927 companies had registered, generating £259 million in tax revenue for 2024–25. Of the total declared plastic packaging, 38% was taxable, while the remaining 62% either met the 30% recycled content threshold or were exempt due to export or other criteria. These figures demonstrate that material specifications and supply chain design are increasingly driven by both price signals and compliance obligations, prompting companies to integrate recyclability, renewability, and traceability into the early stages of product development and procurement.

However, for the circular economy to take root in everyday consumption and brand management, it is vital to address the gap between consumer motivation, willingness to pay, and behavioural change. A study released by Consumer Scotland at the end of 2024 found that 76% of respondents expressed concern about climate and environmental issues, and 80% wished to reduce the carbon footprint of their household purchases. Yet, cost and convenience remain the main obstacles to behavioural change: 63% cited the price of low-impact products as one of their top three concerns, while 62% mentioned the limited availability of such products and the lack of clear environmental impact labelling for comparison.

Conversely, only 10% of respondents stated they were “likely” to change their shopping habits in the coming year due to environmental concerns—highlighting that high levels of concern do not necessarily translate into sustainable action. This reminds brands and retailers that circular design, pricing structures, and communication strategies must work together to ensure that good design crosses the “last mile” into everyday purchasing decisions.

Capital markets are also reassessing the growth trajectory of circular commerce. In 2024, disclosed funding related to the UK’s circular economy reached £2.2 billion, a 64% year-on-year increase. While the number of deals remained relatively stable, the average deal size grew—indicating that investors are shifting from proof-of-concept to scaling. They are now prioritising business models that can deliver cost advantages, regulatory certainty, and supply chain resilience across the entire value chain.

For FMCG companies, this suggests that systemic innovations—such as reusable packaging systems, refill and recycling–remanufacturing loops, and traceable materials platforms—will become prime targets for investment and mergers and acquisitions.

Drawing from these policy signals and market trends, FMCG transformation strategies should embrace integrated governance across design, procurement, distribution, recycling, and remanufacturing:

Design stage: Prioritise single-material and separable structures, maximise the use of recycled materials, and reduce consumer decision-making costs through clear labelling (e.g. recycled content, recyclability guidance, and collection points).

Procurement stage: Secure stable supplies of recyclable and recycled materials through long-term contracts, joint development, and pre-certification mechanisms.

Distribution stage: Collaborate with retailers to establish collection and reuse systems—embedding refill packs, deposit schemes, and recycling points into everyday consumer journeys rather than treating them as isolated demonstration projects.

Recycling and remanufacturing stage: Combine Extended Producer Responsibility (EPR) with local infrastructure investment to achieve economies of scale, transforming compliance costs into marginal cost advantages in material recovery.

Such practices not only respond to the government’s commitments to roadmaps and infrastructure but also align more closely with consumers’ real-world decision-making processes. When price, convenience, and quality can be met simultaneously, recycling has the potential to become the new norm.

Finally, it is important to note that stagnant recycling rates and regional disparities cannot be resolved by a single policy measure. They depend on local governments’ resource allocation, the standardisation of collection and sorting systems, and joint efforts from businesses in designing recyclable packaging. Once the central government releases a clear recycling strategy with departmental roadmaps and infrastructure investment plans, the sooner FMCG companies complete material audits, risk assessments, and product portfolio reconfigurations, the better they can transform compliance obligations into a dual advantage of brand value and supply chain resilience.

References

Reed pledges to “end throwaway society” working with business to slash waste, boost growth and clean up Britain. UK Government News, DEFRA (2025). https://www.gov.uk/government/news/reed-pledges-to-end-throwaway-society-working-with-business-to-slash-waste-boost-growth-and-clean-up-britain

Trends Shaping the FMCG Industry. Unipart (2023). https://www.unipart.com/resource/trends-shaping-the-fmcg-industry

Recycling Going Round in Circles? Frontier Economics (2024). https://www.frontier-economics.com/uk/en/news-and-insights/articles/article-i4886-recycling-going-round-in-circles/

Waste Generation by Major FMCG Companies in the UK in 2021. GlobalData (2022). https://www.globaldata.com/data-insights/macroeconomic/waste-generation-by-major-fmcg-companies-in-the-uk-in/

How to Achieve Sustainable FMCG Packaging. Greyhound Box (2025). https://greyhoundbox.co.uk/blog/sustainable-fmcg-packaging/

Circular Business Models for the Fast-Moving Consumer Goods Industry. ScienceDirect (2022). https://www.sciencedirect.com/science/article/pii/S2352550922000124

Venture Capital and Private Equity Drive Record Investment in UK’s Maturing Circular Economy. BDO UK (2025). https://www.bdo.co.uk/en-gb/news/2025/venture-capital-and-private-equity-drive-record-investment-in-uks-maturing-circular-economy

Consumers and the Transition to a Circular Economy (HTML). Consumer Scotland (2024). https://consumer.scot/publications/consumers-and-the-transition-to-a-circular-economy-html/

Challenges and Opportunities in Implementing Circular Economic Models in FMCG Industries. ResearchGate (2024). https://www.researchgate.net/profile/Tochukwu-Ijomah2/publication/383847272_Challenges_and_opportunities_in_implementing_circular_economy_models_in_FMCG_Industries/links/66dc4181b1606e24c212480d/Challenges-andopportunities-in-implementing-circular-economy-models-in-FMCG-Industries.pdf

Contribution to the Development of a Global Digital Literacy Skills Indicator. United Nations. https://sdgs.un.org/partnerships/contribution-development-global-digital-literacy-skills-indicator